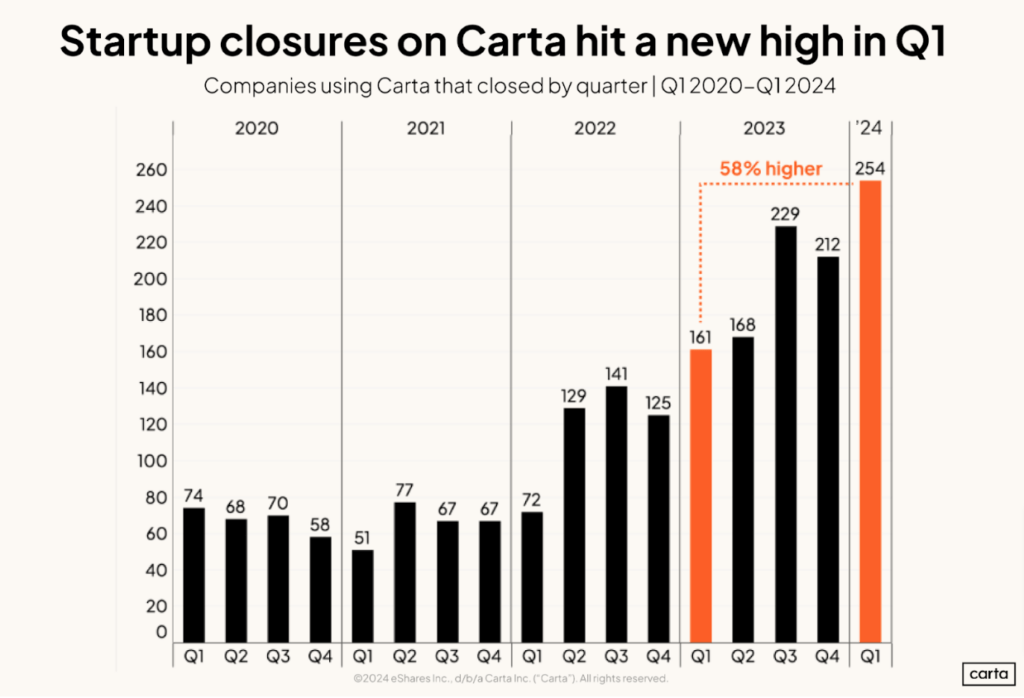

In 2022, a massive correction began in the startup ecosystem. Rising interest rates led to plummeting startup valuations and venture firms struggling to raise new funds. Global venture funding fell 35% between 2021 and 2022, and startup valuations dropped by an average of 34% across all stages. And it has not gotten better – in fact fast forward to the first quarter of 2024, and we have witnessed more startups go out of business than at any time this decade.

Where Are We Now?

- Startups and venture firms are still learning to survive with less. Startups have restructured, prioritized profitability, lowered burn, and extended runway in hopes of deferring their next fundraise.

- Venture firms have slowed new investments, increased diligence, raised prices and deferred new funds.

Where We’re Headed

As we enter the back half of 2024, little has improved. In fact, we may be headed for an even tougher road. If you’re a startup, you might want to stay on the sidelines a bit longer before trying to raise again.

Why?

- It’s never been harder to raise a fund. Limited Partners (LPs) are passing on the venture asset class thanks to stubbornly high interest rates, an aggressive anti-M&A DOJ, and a good deal of US political uncertainty.

- The result is that those investors with capital to deploy are doing more window shopping and less check writing. By slowing down they are stretching out their prior funds hoping to remain active in the market until the LP environment improves. In other words, the supply side of the capital raising marketplace is highly constrained.

Advice For Founders

Nearly 25% of Enjoy The Work’s roster of startups intends to raise outside capital in H2. How are we advising them? With a dead-simple rubric:

Great Metrics; Low Runway

- Action: For our startups with top-tier metrics but a short runway, it’s all systems go. We’re advising them to raise but target a much larger pool of investors.

- Considerations: Even the best startups now face tough odds, similar to a valedictorian student with perfect credentials facing a 30-to-1 shot at their target university.

Great Metrics; High Runway

- Action: For those with strong metrics and ample runway, we advise enjoying the optionality they’ve cultivated.

- Considerations: If there’s a compelling reason to raise now, go for it. But if the need for additional capital isn’t clear, delaying until 2025 for potentially better conditions is a reasonable choice.

Low Metrics; Low Runway

- Action: For startups with low metrics and a short runway, options are limited. If a viable inflection point is ahead, perhaps seek a bridge to find a path to renewed growth. If insider support is lacking, the priority turns to pushing toward profitability to provide a window for an exit.

- Considerations: Even with a short runway, if our founder has built something of value, the market will reveal a buyer. This is the “soft landing” phrase tossed around in boardrooms, likening a failing startup to a pilot trying to ground an aircraft with minimal damage to the plane, cargo or passengers.

Low Metrics; High Runway

- Action: For those with suboptimal metrics but plenty of runway, we suggest ignoring fundraising for now. Focus on running experiments until greater acceleration and evidence of product-market fit can be discovered.

- Considerations: If bet after bet and pivot after pivot come up empty, might closing up shop and returning capital be the sanest option? We only get so many swings before we all turn to dust. Let’s make them count.

Conclusion

At Enjoy The Work, we do believe in founder magic. We’ve seen it time and again. So we know there will be founders who find a way to new capital despite long odds. We don’t wish to sound defeatist. But our job is to provide guidance for what we believe. And in this market, we expect only the best performing startups will enjoy raising capital. For everyone else, we suggest founders save themselves some pain and sit out this round if at all possible.