Capital is the lifeblood of a young startup. It’s not an accident that the very language used to describe money conveys a sense of survival. Burn, fume, runway… The consistent theme is simple — pay attention to your cash or combust, be stranded, or crash.

Yet despite the mortal consequences, founders don’t always fully own this part of their business. For reasons sure to date back to childhood, approaches to cash management tend to fall into a handful of different dysfunctional patterns.

The Ostrich Founder

This entrepreneur is afraid to know the truth. Instead, he places his head in the sand and hides from the danger. In an homage to Schrödinger’s cat, the hope is that not knowing if you’re broke will somehow hold reality at bay.

The Headless Chicken Founder

Always feeling broke is a painful way to run a business, and this founder believes bankruptcy is always just one expenditure away. As a result, everyone in the company is not just careful with money but is terrified to spend it on anything. Shortcuts are always taken. MVPs are used when polished solutions are needed. No amount of cash in the bank helps this founder feel better.

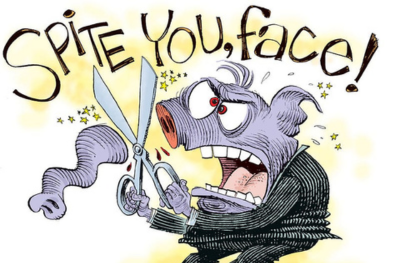

The Founder With No Nose

Spiting one’s own face is never a good idea, but there are entrepreneurs who consistently starve their startups of the resources needed to hit milestones. The tradeoff is never an easy one, but the goal is to find a repeatable business, not just survive an extra month.

The Secret Founder

“Believe it, and it will happen. Magic will occur. Cash will simply appear. Investors will materialize. Revenue will flow.” That’s crap. I’m a proponent of managing your energy, showing up in the world intentionally, and staying focused on a north star. But in startup life, I only believe massive, overwhelming, and consistent action generates cash.

The No-Homework Founder

In 2007 I was transitioning to the Bay Area. I needed a car (Uber/Lyft did not exist yet). I found a listing for a used 1983 diesel Mercedes, contacted the owner, and bought the car. To call the car a lemon would be an insult to lemons everywhere. Everything is relative to a startup’s cash balance, but for big-ticket items, do your homework or find yourself staring at a broken muffler at the corner of Folsom and 9th.

The Too-Much Homework Founder

Not researching big-ticket items is one thing, but too much homework can be equally debilitating. This founder wants ten options for every decision, ten service providers to interview, and ten proposals to consider. This founder tends to see most decisions as having an equal expected impact, and the result is tortoise-like execution. Startups have only one consistent advantage over their more mature competitors — speed. This founder eats away at that edge.

So what’s the right answer?

It starts with a simple rule — embrace the truth of today. Relentlessly understand the math of your business so you know with precision the capital available versus what’s needed to accomplish the next milestone. With a common understanding of the current state of your union, you can invest money responsibly to move forward.

And if one of the dysfunctional archetypes creeps into your business? Remember you’re not alone, and use the smart folks around you as a sanity check. You won’t always get a signal as obvious as the one I received in 2007.