The biggest myth (or outright lie) I’ve heard in the market is: A good product sells itself.

This is not true.

Throughout my twenty plus years in Sales and Marketing, numerous founders with wonderful products have come to me with one common problem: How do they find the right buyer for what they’re selling?

As technologists and engineers, they’re great at building a product, but often flounder when the time comes to go to market and start building their sales pipeline.

I tell them all the same thing: Finding the right customer is like finding love.

A failed romance will leave you devastated; a thriving one will make you feel like you’re on top of the world.

Consider the misguided notion of: “Never miss a sale.” Okay, so going along with our love analogy, does it sound like a good idea to ask out every single person you come across?

Whether in romance or sales, start from what you want in life. What geography works for you? Do you have similar religious beliefs? Life ambitions?

Once you have a brief idea of what you’re looking for, you will know WHO you are looking for and you can begin your search across dating profiles accordingly.

In business, your ideal customer profile (or ICP) is not only someone who will say yes to buying your product but for whom your product solves an essential need. Consider it a mutually beneficial relationship. They want what you offer, and equally important, they are ready to see the value from that offering.

Far too many entrepreneurs try and sell at all costs ignoring warning signs that they might be pushing on the wrong audience, an audience destined for dissatisfaction. While the quick revenue bump will feel good, it is not worth the support issues and inevitable churn. Said differently, sell your product to customers who love to use it.

Identifying your ICP will align your teams and push you toward product market fit. Once your ICP is figured out, successful prospecting, lead qualification, retention, and upselling will follow.

How to Figure Out Your ICP

Start with the people you know. The ones who have tried, used, or (better) even paid for the product already. Is there a pattern?

Ask yourself the following:

- What size company?

- Early stage or Fortune 500?

- What vertical?

- Healthcare, agriculture, energy, legal services?

- What geography? China? The U.S.? Europe?

- How might I create a list of them? Time for that paid Crunchbase subscription.

- How does the customer solve the problem today?? Consulting services? Legacy software?

- How do they learn of those solutions? Conferences? Trade publications? Analyst reports?

- How much are they spending? Hundreds of dollars or hundreds of thousands? Who at that company is making that decision, using the product/service or cutting the check? The CEO might be the buyer but very likely, someone else is the user.

- Are certain technical integrations core to deriving value?

- Are customers of another vendor good targets?

- Does the company or champion seem like early adopters?

As you answer these questions, your ICP will start taking shape. Fill in the blanks with as much color as possible.

One of the companies I advise is a good example. They sell a product to real estate developers. Their ICP playfully is named “Developer Dan.” Developer Dan is a risk taker. He isn’t afraid to take risks with new technology if they promise to solve his problem(s) related to keeping projects on time and on-budget. Dan typically is the VP of Development for a large US-centric real estate development company and manages a $50M-$250M budget. He is new to purchasing software and is mostly unfamiliar with analytics. However, he is hugely motivated to keep his projects on time and on budget. He has employed a great number of tools, processes, and consultants to improve his data gathering and forecasting. Still, there remains room for improvement. Dan attends conferences, reads trade publications, and participates in industry meetups to uncover new technology.

Having a well developed narrative of Developer Dan has allowed my client to build lists, targeted content, and an effective sales strategy; in other words, having an ICP has allowed my client to move faster. For startups, it’s move quickly or die.

A couple of things to keep in mind while you go through this process:

If you receive an inquiry from a customer that falls far outside your ICP, resist the temptation. They aren’t suitable for you, and you aren’t right for them. That wrong customer will eat up more of the sales cycle and drain additional resources trying to force your product to meet their needs. As an entrepreneur, finding a repeatable pattern toward product-market fit is your mission. Stay on the path.

Second, inbound inquiries that are not your ICP but within a margin for error are acceptable to explore more deeply. But it’s essential to evaluate those opportunities as a whole. Discuss with your product customer success and engineering teams. Estimate how expensive they may be to your organization versus the value of a good reference and the associated revenue.

One of my clients is in the middle of this dilemma right now. They have a potential contract with a non-ICP customer that would generate 10x the typical sale price. How could one resist turning an offer like that down? However, everything the client wants is highly custom and it would consume a great deal of the team’s operation and engineering resources. Many of the custom requests are not useful to our ICP. While the cash is appealing, the client’s priority is a sustainable go-to-market strategy. This would send them far afield.

Second, ICPs are not static. As your company matures and your understanding of your market advances, you may shift target audiences. You might consider bigger enterprises or shift internal champions. We have one client who first focused entirely on mid-level finance employees at US SMBs. Two years later, they were selling to CFOs at public companies.

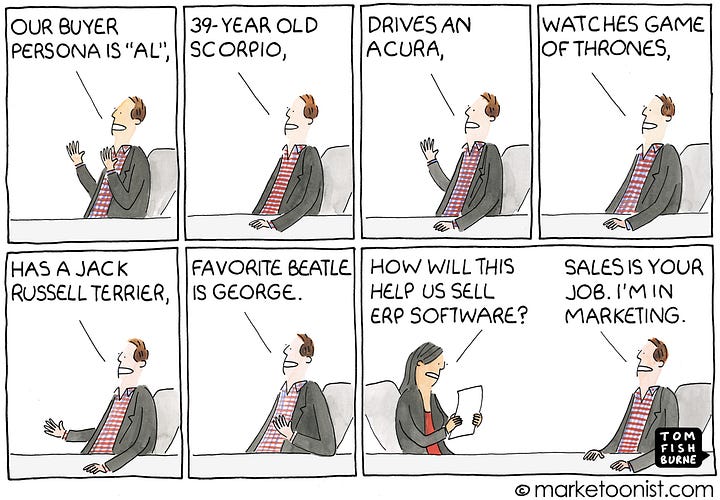

Third, ICPs are different from personas.

Marketing personas describe people. ICPs take into account the entirety of the target audience including the makeup of a champion. A champion will take a risk on your company’s behalf. They will help you navigate their company’s buying process. They will evangelize the pain they’re feeling and vouch for the product’s effectiveness. They will be in it with you — just like a relationship.

A fraction of startups survive. And sadly, so do a fraction of romances. Choose your relationships wisely. Consider all of the variables. Too often, startups focus just on those customers who might say yes. But equally importantly, they should be choosing those they can make happy.